Various ways of salary structuring of employees

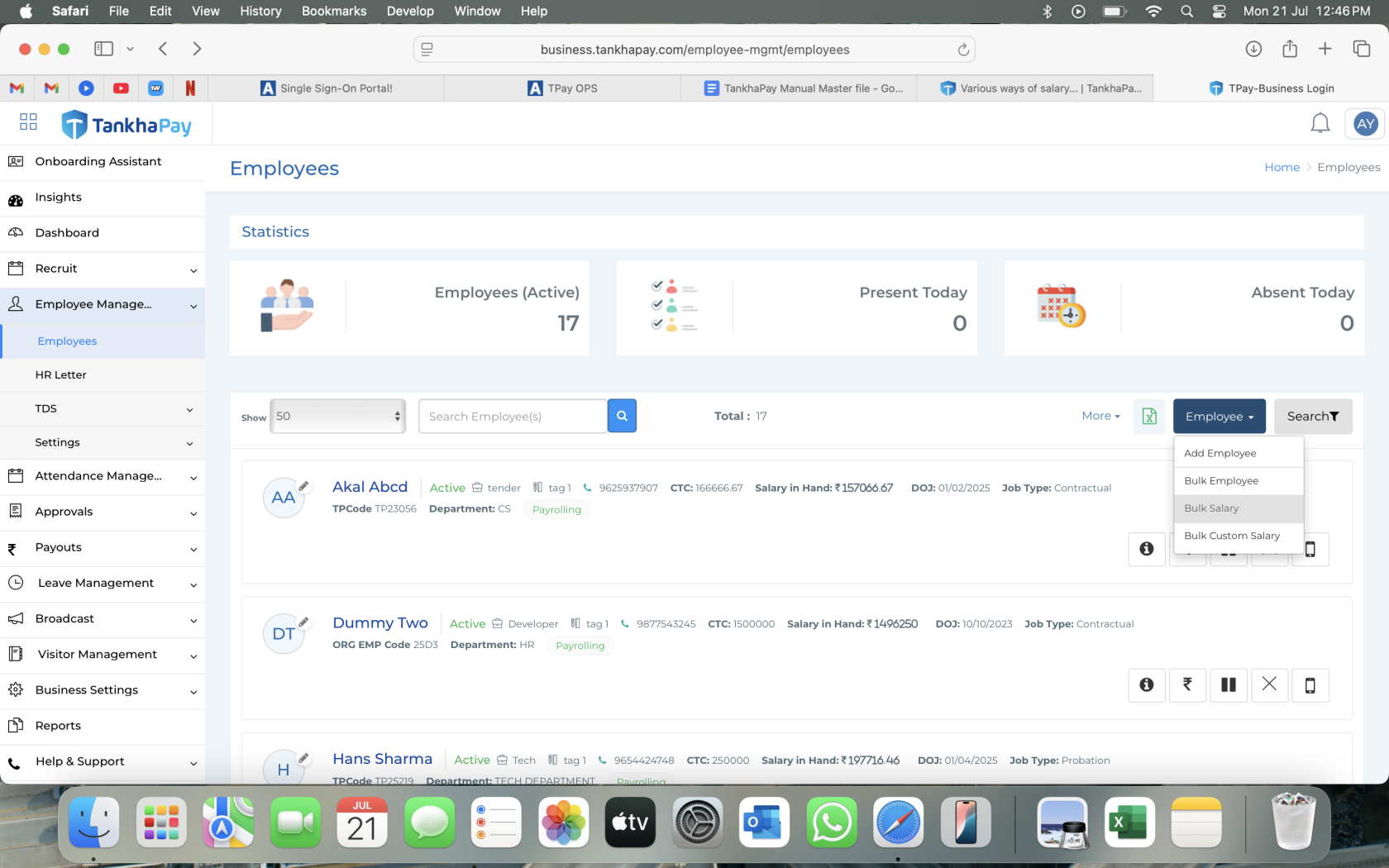

Bulk Salary

This option allows you to structure salaries in bulk without incorporating statutory components .

It is suitable for organisation's that do not require statutory salary breakdowns.

Steps to use Bulk Salary: Click on Bulk Salary > Download the template > Fill in all the

required details > Save and upload the completed file to apply salary structures in bulk

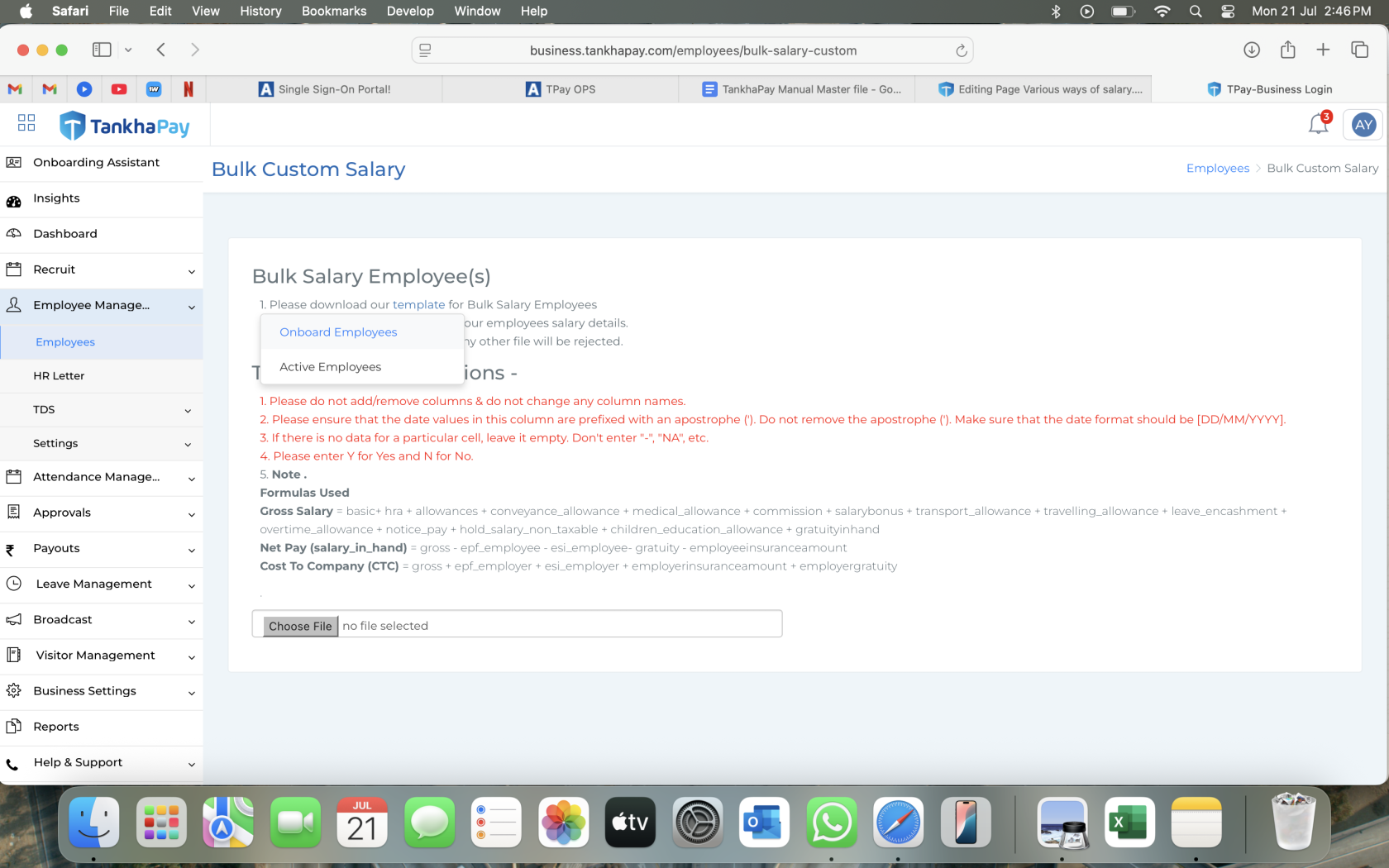

Bulk Custom Salary

This option allows you to structure and customise salaries in bulk incorporating statutory

components like PF, ESI, and other deductions.

When you click to download the template, you will get two options:

Onboard Employee - to structure salaries for newly added employees

Active Employee - to update salary structures for employees already active in the system

Steps to use Bulk Custom Salary: Click on Bulk Custom Salary > Download the required template

(Onboard or Active Employee) > Fill in all mandatory fields > Save and upload the completed file

Custom Salary Nomenclature

1. Employee name – Full name of the employee.

2. Orgempcode – Employee’s organizational code or ID.

3. Tpcode – Unique code assigned by TankhaPay (auto generated if there is no Orgempcode).

4. Monthlyofferedpackage – Total monthly salary offered.

5. Basic – Base salary, forming the basis for statutory deductions.

6. HRA – House Rent Allowance.

7. Allowances – Other miscellaneous allowances.

8. Conveyance_allowance – For daily travel to and from work.

9. Medical_allowance – Fixed amount to cover medical costs.

10. Commission – Variable earnings based on performance.

11. Salarybonus – Bonus amount over regular pay.

12. Transport_allowance – commute-related expenses.

13. Travelling_allowance – official work-related travel allowance

14. Leave_encashment – Pay for unused leaves.

15. Overtime_allowance – Payment for extra hours worked.

16. Notice_pay – Compensation in lieu of notice period.

17. Hold_salary_non_taxable – Non-taxable held salary, if any.

18. Children_education_allowance – Tax-free education support (mostly for government employees).

19. Gratuityinhand – Gratuity amount paid out directly.

20. Gross – Total earnings before any deductions.

21. Pfcapapplied – Indicates if PF (12%) is applicable on basic

22. pf_employer – Employer’s contribution to EPF.

23. Epf_employee – Employee’s contribution to EPF.

24. Esi_employer – Employer’s contribution to ESI.

25. Esi_employee – Employee’s ESI deduction.

26. Salary_in_hand – Net salary received by the employee.

27. CTC (Cost to Company) – Total annual cost incurred by employer.

28. Salarydays – Number of payable days in the month.

30. Lwfapplicable – Labour Welfare Fund

31. Ptapplicable – Professional Tax applicable

32. Location_type – Metro or Non-Metro classification.

33. Minwagestatename – State where the company is located.

34. Effectivedate – Date from which salary is effective.

35. Dateofjoining – Employee’s joining date.

36. Gratuity – lump sum amount made by an employer to an employee as a token of appreciation for long-term service (Gratuity payable as per eligibility)

37. Pfapplicablecomponents – Salary components used to calculate PF.

38. Esiappliedcomponents – Components considered for ESI.

39. Isgroupinsurance – Whether group insurance is provided.

40. Employeeinsuranceamount – Insurance coverage amount for employee.

41. Employergratuity – Employer's contribution toward gratuity.

42. Ishourlysetup – if the salary is to be calculate on hourly basis